We will continue last edition’s mentioning of the various Financial Statements, but before we continue, we need to go back to the Anatomy of The Profit & Loss Statement. As stated it is important that we structure it in such a way that we can learn much more about our business, then just the bottom line.

We need to be able to quickly understand what is happening in our business that is affecting our net profits, so that we may better improve our results.

How this financial statement will look and read is dependent on how we structure the Chart of Accounts.

In the United States, I believe that most small and medium-sized businesses are using QuickBooks. Whether you use QuickBooks or not, accounting and bookkeeping principles are the same. The various platforms may differ a little in the user interface and design, but ultimately the financial statements are pretty much all the same.

When we begin setting up the Chart of Accounts in for instance QuickBooks, QuickBooks will suggest a few typical accounts for you

Here are a few of the most common accounts QuickBooks creates for you ((source: quickbooks.intuit.com):

Accounts Payable (A/P)

A record of the outstanding bills that your business owes. If your business uses multiple A/P accounts, QuickBooks will let you choose the account you want to use when you enter and pay bills.

Accounts Receivable (A/R)

A list of transactions related to customers who owe you money. If you need to use more than one A/R account, QuickBooks will let you choose the A/R account that you want to use when you create an invoice or receive a payment.

Opening Balance Equity

Ensures that you get a correct balance sheet for your company, even before you’ve entered all your company’s assets and liabilities.

Payroll Expense

Tracks payroll items (expense) for the company, including salaries, wages, bonuses, commissions, company contributions such as company paid health plan and company paid portion of taxes such as Social Security and Medicare.

Payroll Liabilities

Tracks taxes you deduct from your employees’ salary until you turn them over to the government, including federal and state income withholding taxes, local taxes and the employee paid taxes like Medicare and Social Security.

Retained Earnings

Tracks profits from earlier periods that have not yet been distributed to owners. At the beginning of the fiscal year, QuickBooks automatically transfers net income into your retained earnings account.

Sales Tax Payable

Tracks all sales tax you collect and pay. You might not see this account if you haven’t turned on sales tax in QuickBooks.

Uncategorized Expense

Money your business spends that needs to be categorized.

Uncategorized Income

Money your business earned that needs to be categorized.

Undeposited Funds (also called Payments to Deposit)

Holds cash or checks that your business is ready to deposit at the bank.

Inventory Asset

Tracks the current value of your inventory. You might not see this if you haven’t turned on inventory tracking.

Reconciliation Discrepancy

Tracks reconciliation adjustments. This account is automatically created if you have a discrepancy in a reconciliation.

Several of the above-mentioned accounts are accounts that pertain to the Balance Sheet and will not show up on our Profit & Loss Statement. We need to set up our specific accounts that are relevant to our business.

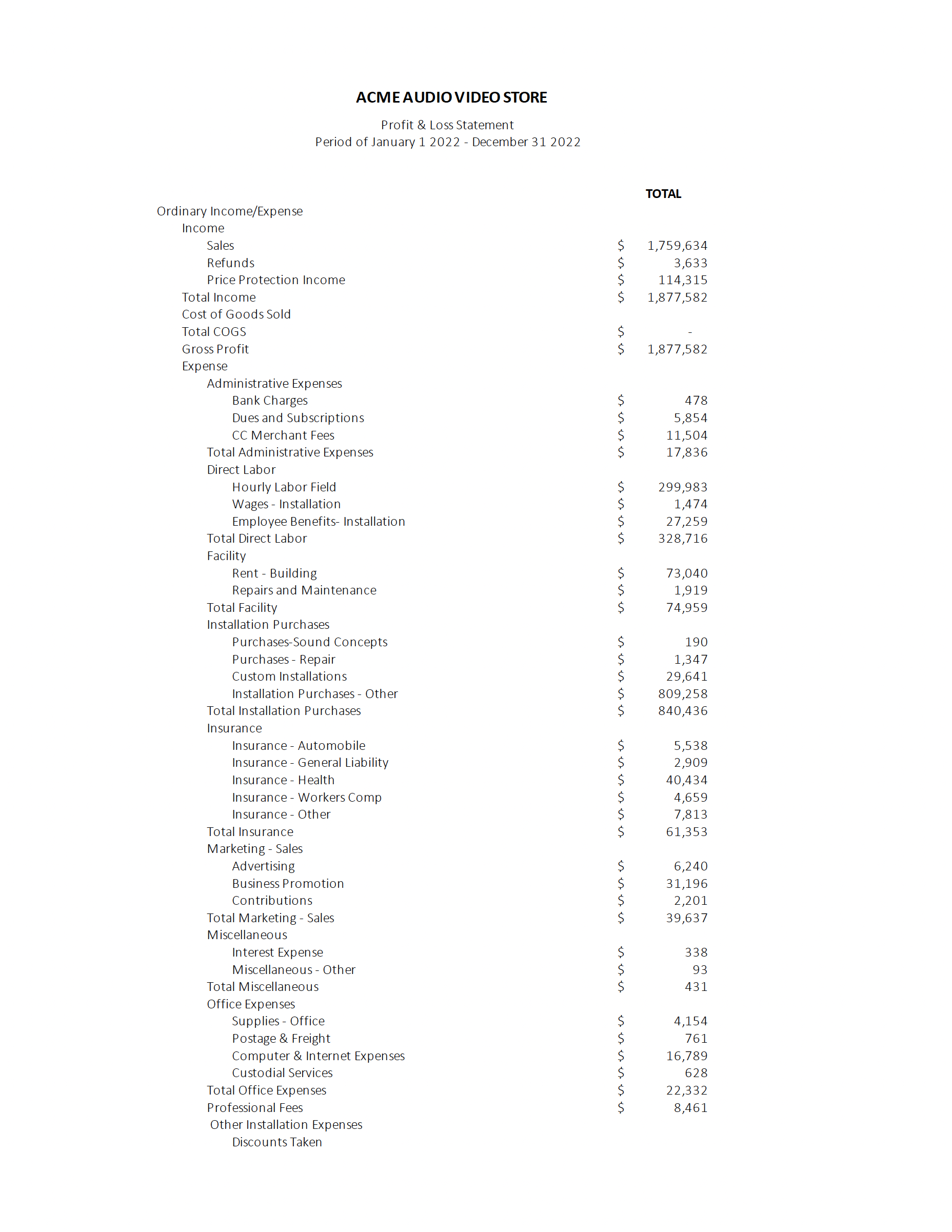

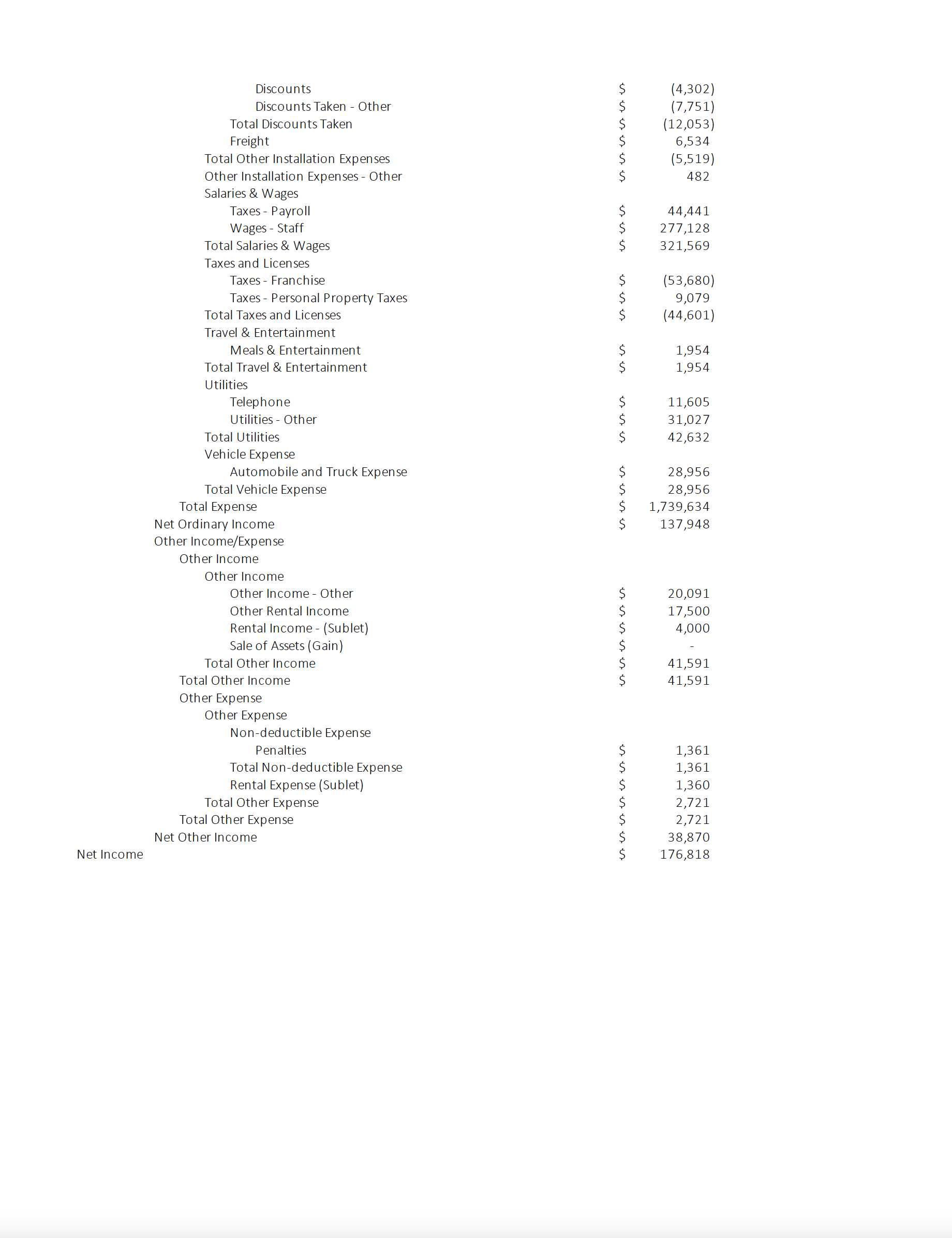

In the following I am using an Audio Video Store as our example, so several of our accounts will be relevant to that. For you, who are likely in some other type of industry, you will set up accounts relevant to your business. Several of the accounts though will be similar, such as Salaries, Office Rent, Vehicle Payments, Office Supplies, Utilities, etc.

Unless you structure things differently, QuickBooks will order your accounts by alphabet, which means that your Expenses Profit & Loss Statement will be listed in alphabetical order.

Also, unless you assign specific accounts as a Cost of Goods Sold account, you will end up with a Profit and Loss Statement that has no identified Cost of Goods Sold accounts, and thus you will have on your Profit & Loss Statement a Total Cost of Goods Sold or COGS equal to $0, and therefore your Gross Profits will be equal to your Total Income, just as can be seen from example I below.

While we have all the information pertaining this business’ Profit & Loss results, we are lacking several pieces of information in detail that will enable us to better understand where we may need to set in with some actions in order to improve our business further.

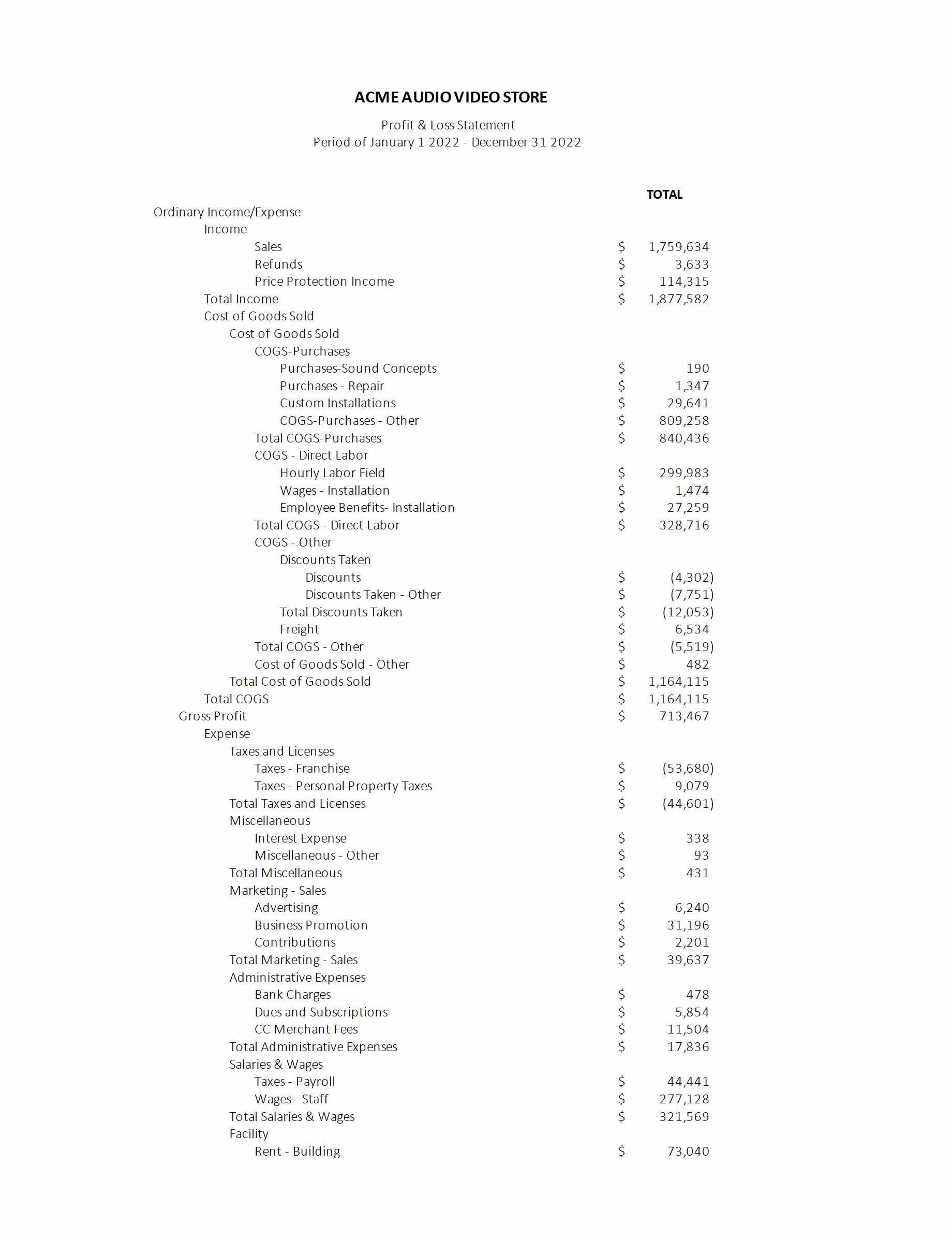

As I have mentioned in previous articles in this series it is essential that identify all the accounts that hold numbers for the expenses that are directly related to delivering upon our sales.

In our case with the Audio Video Store, this would mean accounts that hold expenses for all the equipment (materials) that we sold, all installation expenses, installers’ time (Direct Labor), all supplies specific to this etc.

In other words, we need to identify specifically all our Costs of Goods Sold. As explained in previous editions of this newsletter, this is the same as all our Direct Costs or all of our Variable Costs.

As we shall more than likely see in later editions, these are not always cut in stone, and there can be some situations, where one can argue that an expense should be considered a Direct Expense, but also could make an argument for why it should be considered an Expense, i.e. a Fixed Cost (also known as Overheads).

One way of thinking about Direct Costs, Variable Costs or Cost of Goods Sold (pretty much just 3 different terms for the same thing), is to think of it as a cost that you would not have unless you had a sale.

Or if it helps you further, “an additional cost that you would not have if you did not make the additional sale.”

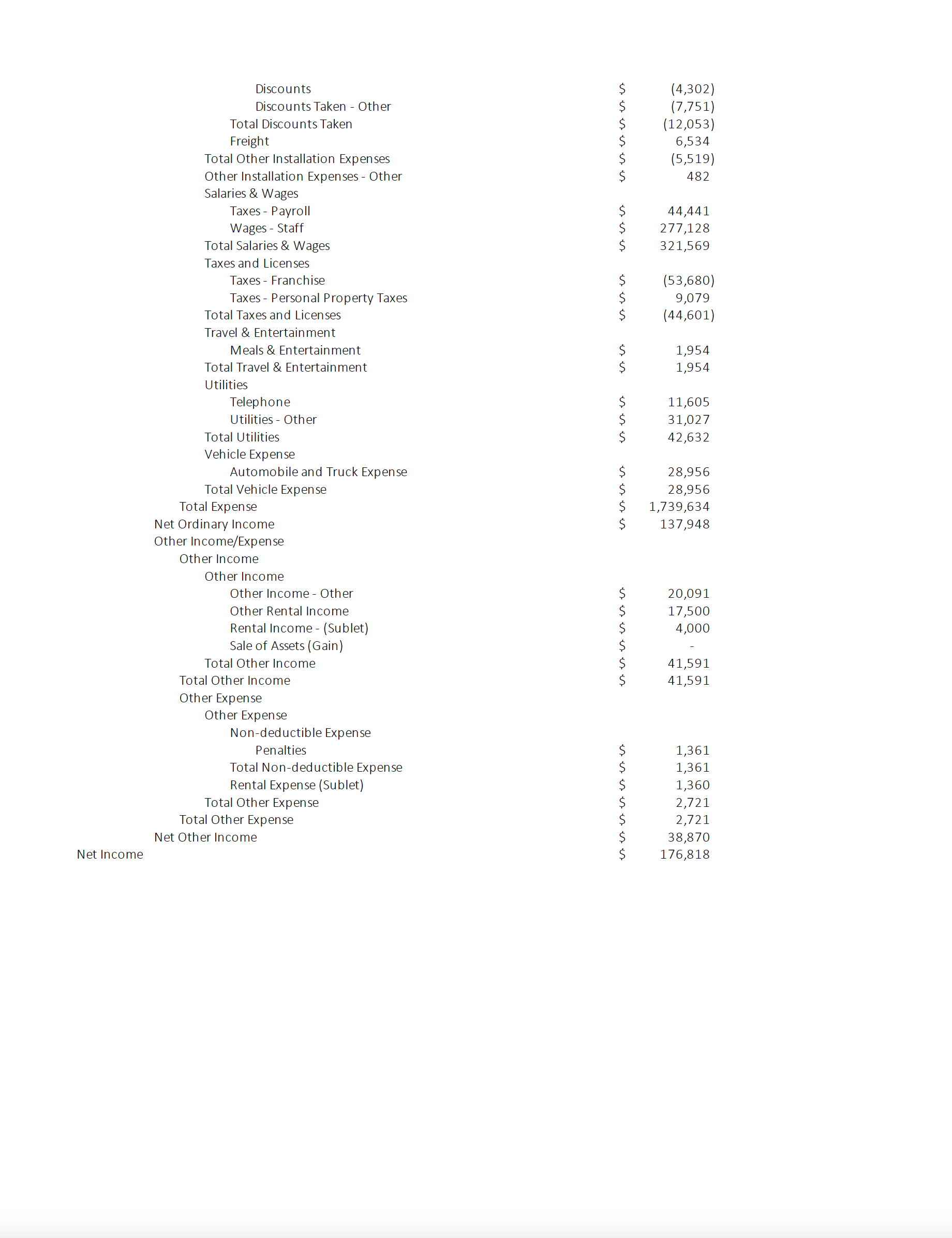

Here is what we probably would like to have our Profit & Loss Statement look like after we have identified our Cost of Goods Sold accounts:

While we can see the numbers are the same in the Before and After example of our Audio Video Store above, we can quickly see the that we now have identified a total of Cost of Goods Sold of $1,164,115 which then gives us the Gross Profit of $713,467.

As you saw from the first Profit & Loss Statement, we have the same Total Income of $1,877,582 and the same Net Income (Net Profit before Tax) of $176,818. But before we made our adjustment in the Chart of Account our Cost of Goods Sold were $0, resulting in a Gross Profit equal to our Total Income, i.e. $1,877,582.

After our adjustment, we have our Total Cost of Goods Sold as $1,164,155 thus leaving us with a Gross Profit of $713,467.

This is an invaluable additional piece of information that we must have if we wish to be able to really understand what is going on in our business and for understanding better where we may have opportunities for making some adjustments to make improvements in our results.

Most businesses that I have dealt with do have some of their cost of goods sold accounts identified, but many have overlooked several that should be moved from Expenses (Overheads) to Cost of Goods Sold.

At least about 20% of the clients that I have served over the years, did not have any Cost of Goods Sold identified, and many more had several accounts that really did need to be moved.

I have to admit also, that in my early days in business, while I had some vague idea about Gross Profits, I did not have Cost of Goods Sold accounts identified and thus had Profit & Loss Statements that resembled the first example. I should add to this, that this was even in a relatively large company which had a very intelligent and knowledgeable former CPA engaged as its Director of the Accounting Department.

It goes to show, that you as a business owner and business leader need to know what you need to have at your fingertips and need to know what to look for. This is why we all need Mentors, because this goes to show that we don’t know, what we don’t know. It also goes to show that just because you have smart, intelligent people employed, who probably are stronger in some areas of the business, you as the business leader still need to have some idea what is required for you to make the most of the business.

So far we have just scratched the surface of why we need this separation of numbers in our accounts and our resulting Profit & Loss Statement. We shall look much deeper into the importance of this as we progress.

I suspect most of you already have your Chart of Accounts set up fairly correctly and much aligned with the above message and that’s great, but for those who need to make the adjustments, this is my nudge to you to go and get this done right away (it really only takes a few minutes to get done).